US Dollar Technical Analysis (DXY, AUD/USD, USD/JPY)

- High impact economic data subsides next week, allowing room for the dollar to regain its composure

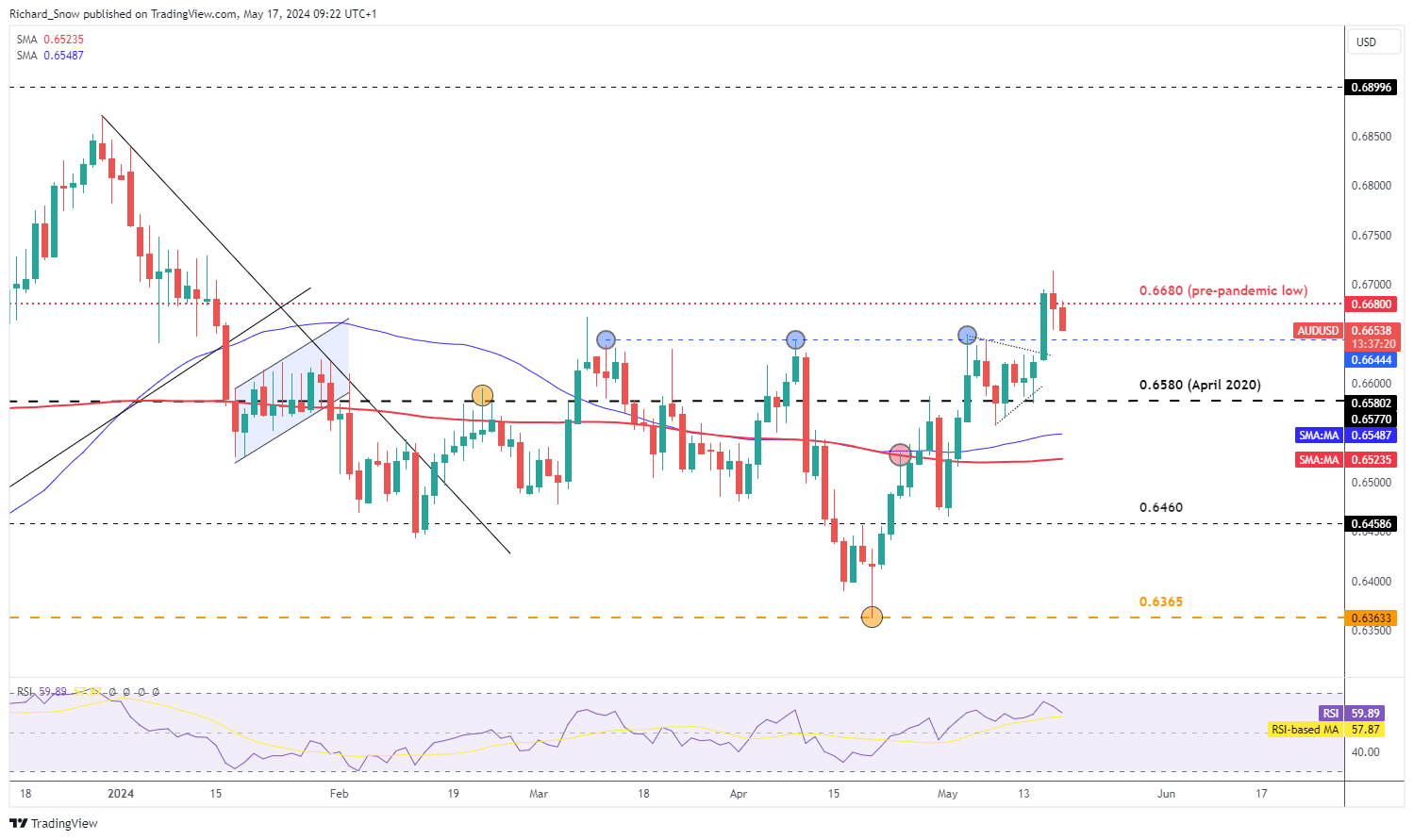

- AUD/USD eases after bullish breakout attempt

- USD/JPY edges higher, testing Japanese officials once more

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

‘High Impact’ Economic Data Takes a Step Back, Allowing Room for the Dollar to Regain Composure

The dollar sold-off notably after US CPI but has attempted to recoup those losses. Markets welcomed a lower headline and core CPI print with monthly measures cooling as well. As such, the focus has returned to rate cuts for the Fed, although greater confidence that inflation is falling towards the 2% target is still required within the Fed’s ranks. Markets now price two 25 basis point cuts into year end, looking like September and December will be the meetings to look out for but market expectations can change very quickly if incoming data deviates substantially from the consensus.

US Dollar Partially Claws Back Losses

The broad measure of dollar performance, the US Dollar Basket (DXY), has partially recovered from the recent decline, finding support around the intersection of the 200-day simple moving average (SMA) and the 38.2% Fibonacci retracement of the late 2023 advance ending in April of this year.

DXY now faces immediate resistance at the 50 SMA and the 61.8% Fib retracement of the 2023 decline. Next week sees a slowdown on the economic calendar with the FOMC minutes the main piece of new information. Quieter weeks tend to result in reduced volatility, meaning the FX market may revert to chasing high yielding currencies, like the dollar. One risk to the outlook is the sheer amount of Fed speakers lined up for next week alongside an address from the US Treasury Secretary General Janet Yellen.

US Dollar Index (DXY)