Japanese Yen (USD/JPY) Latest

- Japan FinMin Suzuki highlights cohesive approach with BoJ

- USD/JPY defiantly ramps up to dangerous levels despite warnings

- Interest rate differential will continue to promote the carry trade until significantly reduced

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japanese Finance Minister Highlights Importance of Working with BoJ

The Japanese Finance Minister has had more to say in the aftermath of the suspected FX intervention in late April as USD / JPY continues making strides to the upside, tempting officials to act again.

Minister Suzuki has stressed that government and the Bank if Japan (BoJ) must work together to execute their respective policies, as the BoJ seek to raise interest rates and government officials seek to support a modest economic recovery.

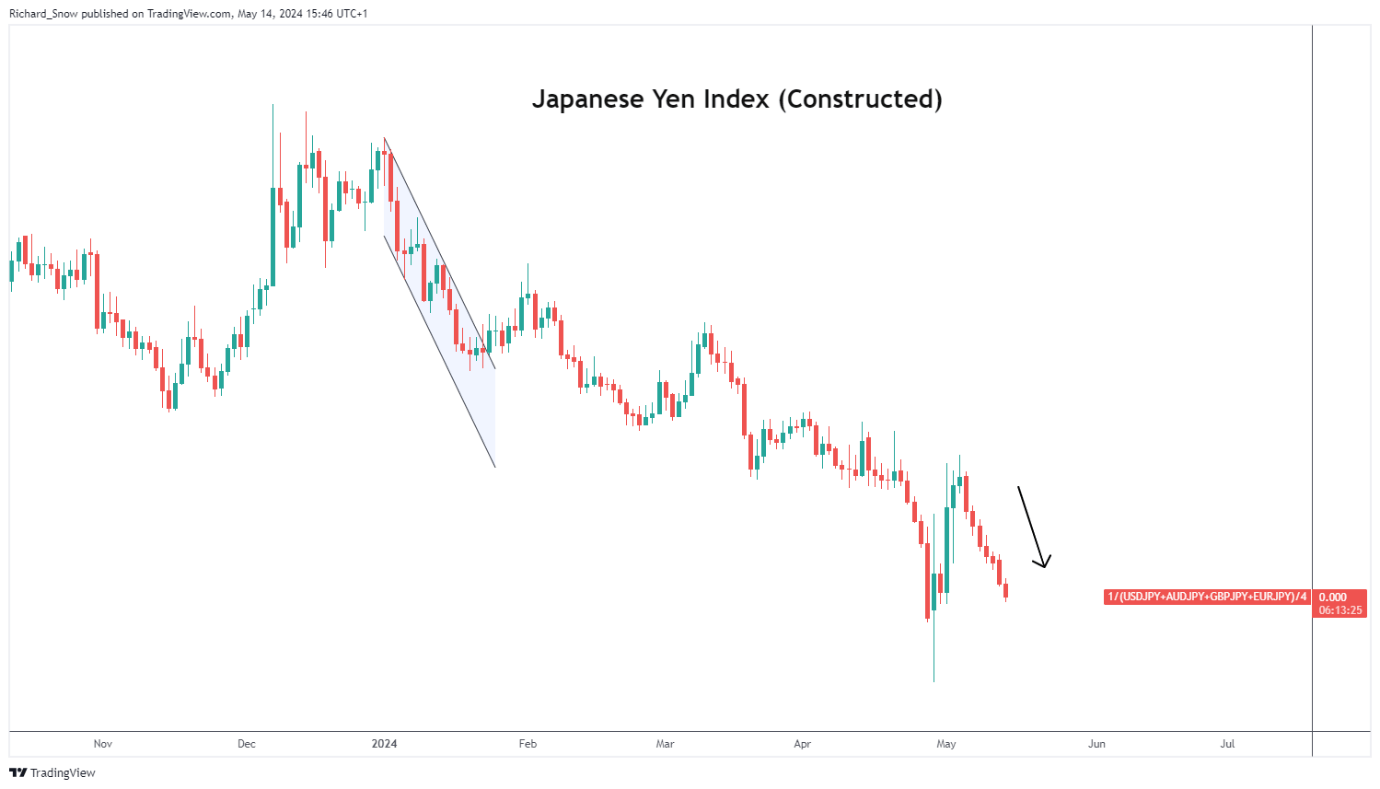

Suzuki went on further to repeat his usual warnings that the ministry is closely watching FX moves and that currencies need to move in a stable manner – reflecting fundamentals. Looking at a general index of yen performance vs a basket of major currencies, the yen continues to depreciate in a consistent manner.

Japanese Yen Index (Equal Weighting in USD/JPY, AUD/JPY , GBP/JPY , EUR/JPY )