Gold (XAU/USD), Silver (XAG/USD) Analysis

- Gold trades higher after data and central bank developments buoy precious metals

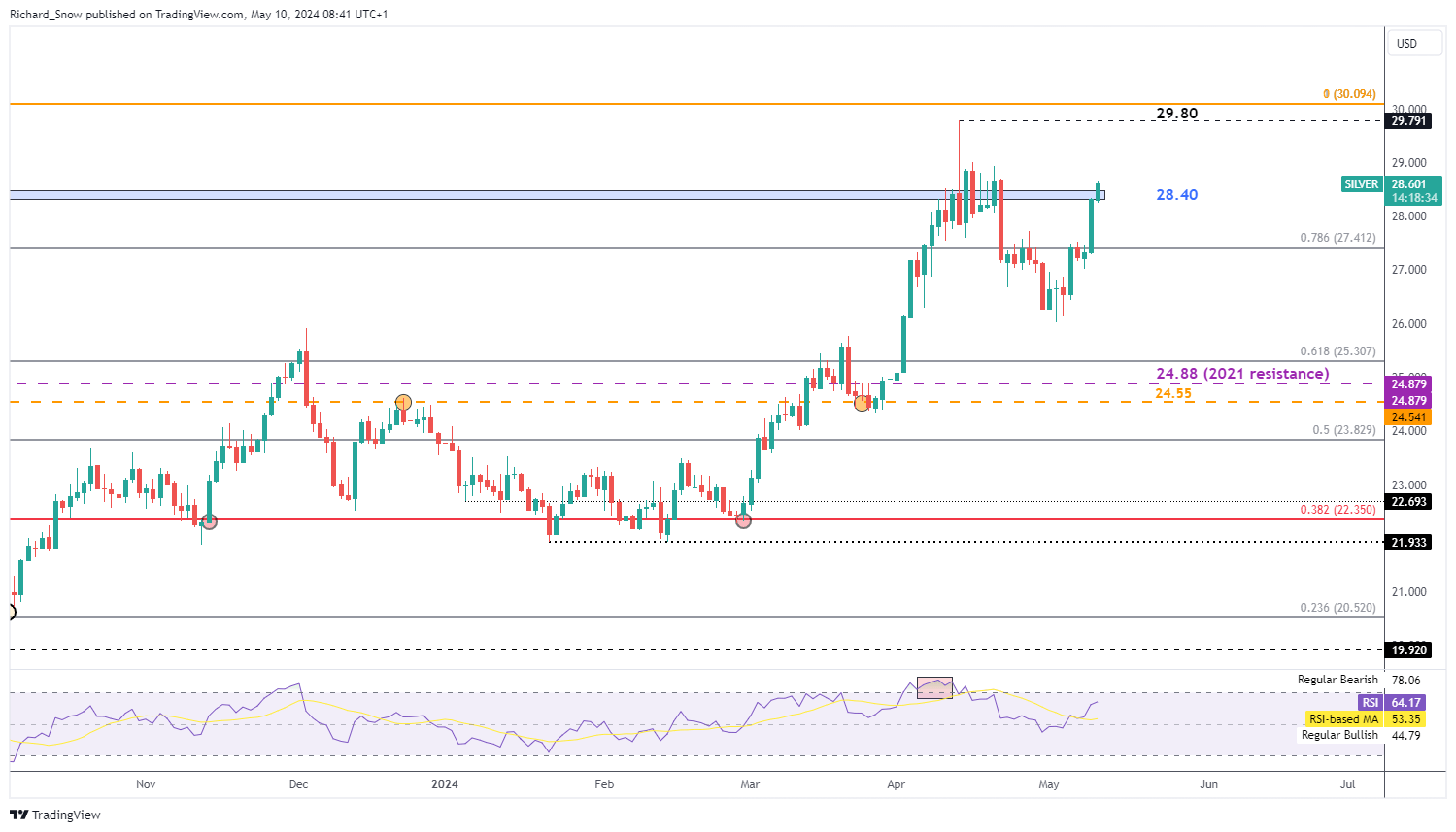

- Silver tests prior zone of resistance after latest bullish impetus

- US CPI data next week is the next potential market mover

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Gold Rises into the Weekend as Data and Central Bank Developments Buoy Precious Metals

Gold has re-established its bullish momentum on the back of worse-than-expected US initial jobless claims data which adds fuel to the idea that central banks will soon be in a position to cut interest rates. Just yesterday the Bank of England hinted that interest rate cuts may materialise sooner than initially anticipated on the back of ‘encouraging’ inflation data in the UK. The medium-term inflation outlook printed within the 2% target (1.9% vs 2.3% in the February forecast), laying the groundwork for cuts.

The overall feel of the BoE meeting had a sense that rate cuts are on the horizon provided the committee receive greater confidence that the persistence element behind inflation is dissipating. In the absence of any unwarranted inflation surprises, it would appear the committee is readying for a policy shift which tends to present a tailwind for the precious metal.

In addition, the increase in initial jobless claims highlighted the weaker-than-expected NFP data for April. The job market has been resilient and the accumulation of these softer data points adds to growing calls for US rate cuts. As we head closer to these inevitable monetary policy shifts, expect markets to remain reactionary to incoming data. Next week US CPI data will be key in either extending the bullish move for precious metals or invalidating it.

Customize and filter live economic data via our economic calendar

Elevate your trading skills and gain a competitive edge. Get your hands on the Gold Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

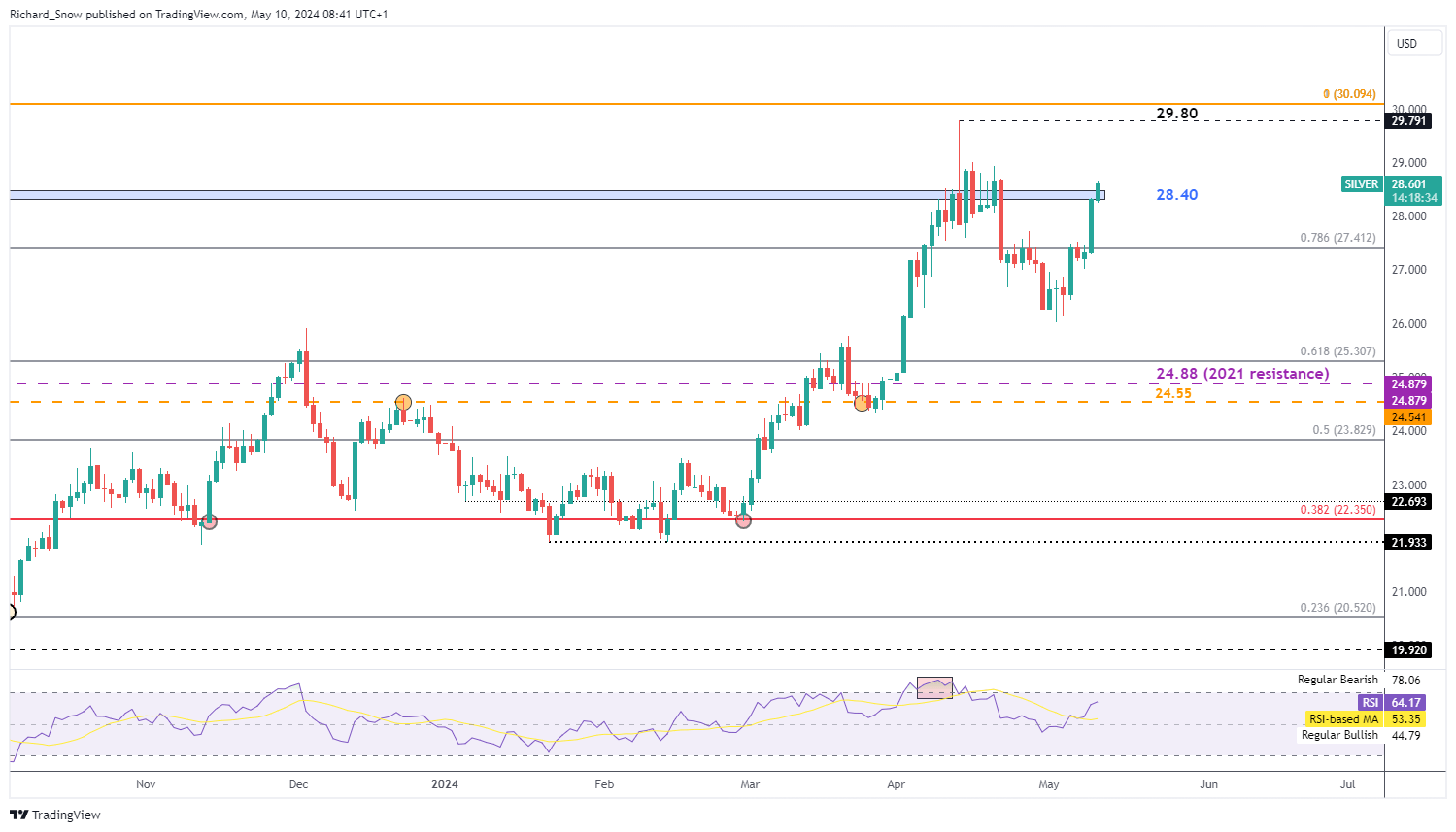

Gold Trades Higher but Can the Momentum Hold into Next Week?

Gold trades higher, buoyed by central bank developments and weaker US jobs data. Another potential driver behind gold’s ascent is the Israeli advance into Rafah. Whenever escalations rise or a new phase of the conflict emerges, markets have added to gold positions ahead of the weekend as a hedge.

Gold has bounced off the prior level of support at $2319.50 and tests the 161.8% retracement of the major 2020 to 2022 decline. Bullish momentum finds another test at the downward sloping trendline resistance drawn from the all time high but the RSI is yet to breach overbought territory – suggesting a bullish bias remains constructive. Support remains at $2319.50.

Gold Daily Chart