Euro (EUR/USD, EUR/GBP) Analysis

- Threat of political fragmentation in France remains a source of concern

- Political uncertainties outweigh US CPI reprieve in a busy week for the euro

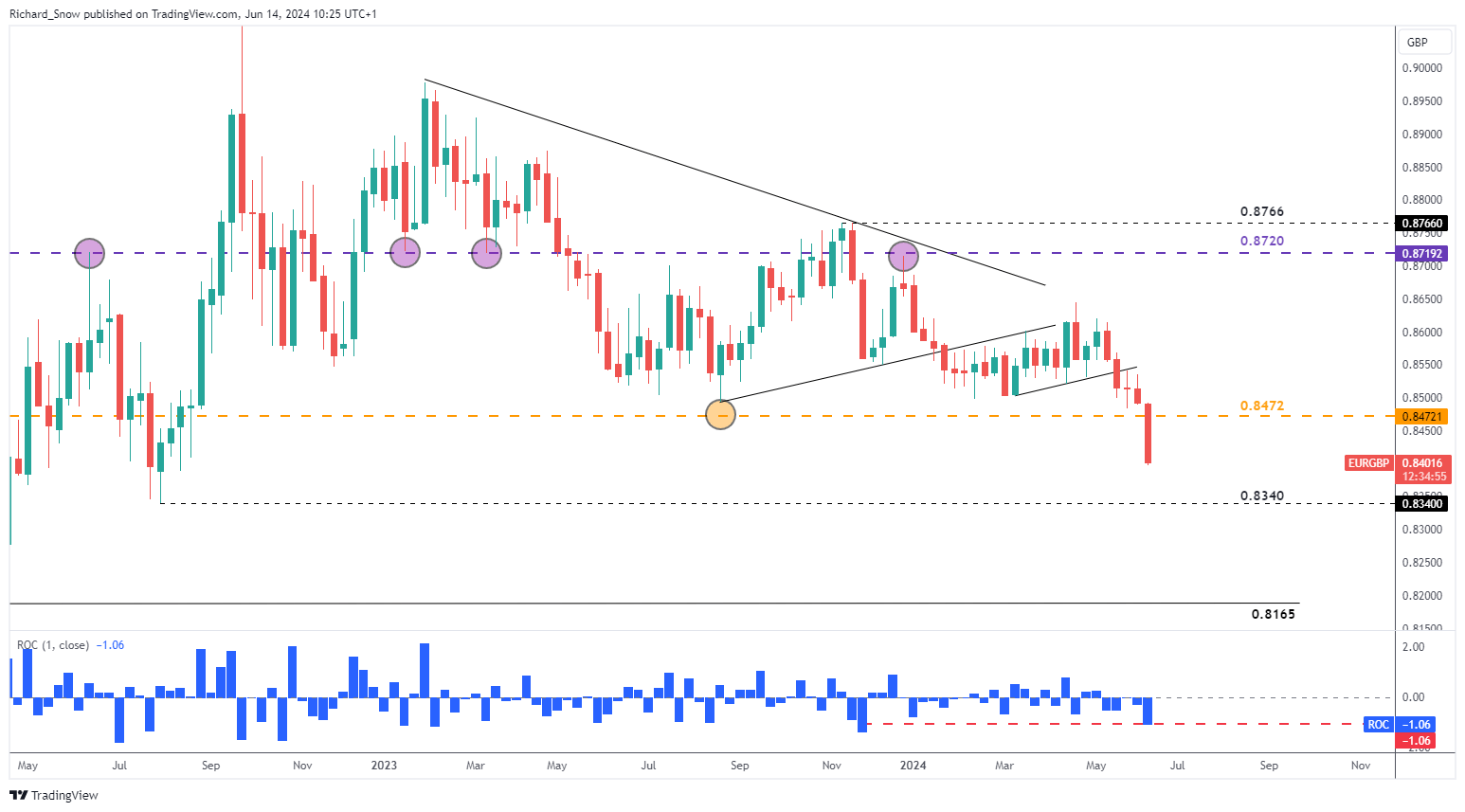

- EUR/GBP on track for its largest weekly decline since November

- Get a hold of our FX trading starter pack where you will uncover the fundamentals of the forex market, learn how to trade around high impact news events/data and how to incorporate an index trading strategy to the forex market:

Threat of Political Fragmentation in France Remains a Source of Concern

European bond markets paint a worrying picture as a move to safety has widened the French-German spread recently, a sign of unease within the bond market. A sharp drop in 10-year bund yields outweighed the recovering French equivalent to raise the spread between the two nations, depicting nervousness on the continent. The euro tends to weaken when bond risk premiums rise across Europe. Another notable bond spread to keep an eye on is the BTP-Bund spread (Italian-German).

German bonds are viewed as safer and prices of such bonds rise when investors pile seek safe harbour from riskier alternatives within the EU – particularly those of Portugal, Italy, Greece and Spain but also France given the recent political developments.

On Friday French parties on the left of the political spectrum are set to reveal the manifesto of their renewed alliance which promises to lower the retirement age, link salaries to inflation and usher in a wealth tax for the rich. The alliance seeks to complicate the political landscape in France after President Macron called for snap elections in reaction to a poor showing during European elections, losing out to Marine le Pen’s right-wing party (National Rally, RN). The first round of elections gets underway on June the 30th with the Euro and CAC 40 expected to weaken in the lead up.

European Bond Markets Reveal Concern