US Dollar Jumps After NFPs Thump Expectations, Gold Hits a One-Month Low

NFPs beat by a wide margin.

US dollar index jumps by over half-a-point

Gold testing a fresh one-month low.

The latest US Jobs Report showed 272k new roles created in May, dwarfing expectations of 185K and April’s 165k (revised lower from 175k). The unemployment rate rose to 4.0%, from 3.9%, while monthly average earnings rose to 0.4% from 0.2% last month.

Today’s release contrasts weak ADP and JOLTs jobs data released this week, which has boosted the dollar as US rate cut expectations fade further. The market is implying that the first cut may happen in November although this isn’t fully priced.

The dollar index has been under pressure this week from the weak ADP and JOLTs data but regained all of this week’s losses after the NFP numbers hit the screens. The dollar index has broken back above the 200-dsma and the 38.2% Fib retracement and is currently testing the multi-month trend support.

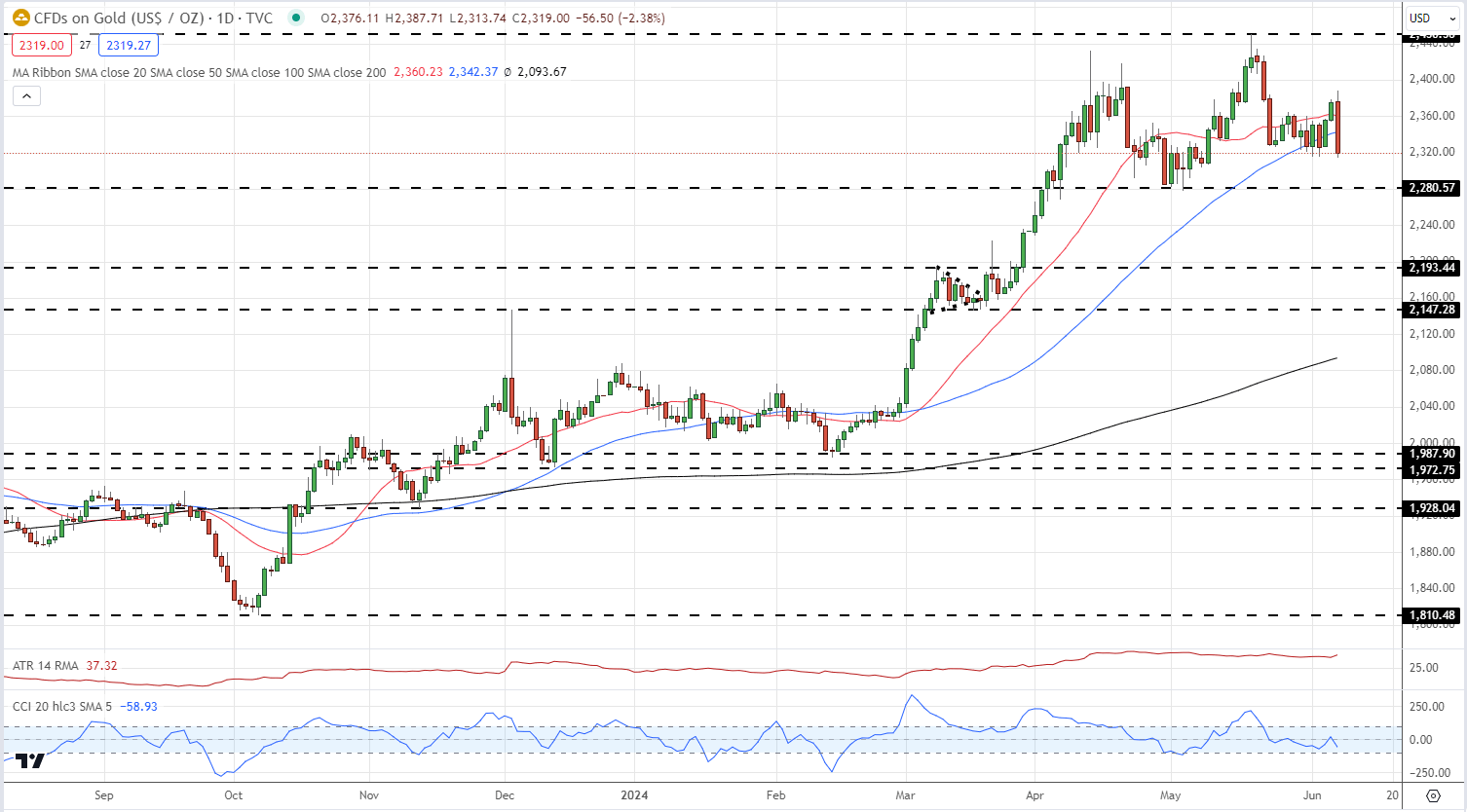

US Dollar Index Daily Chart

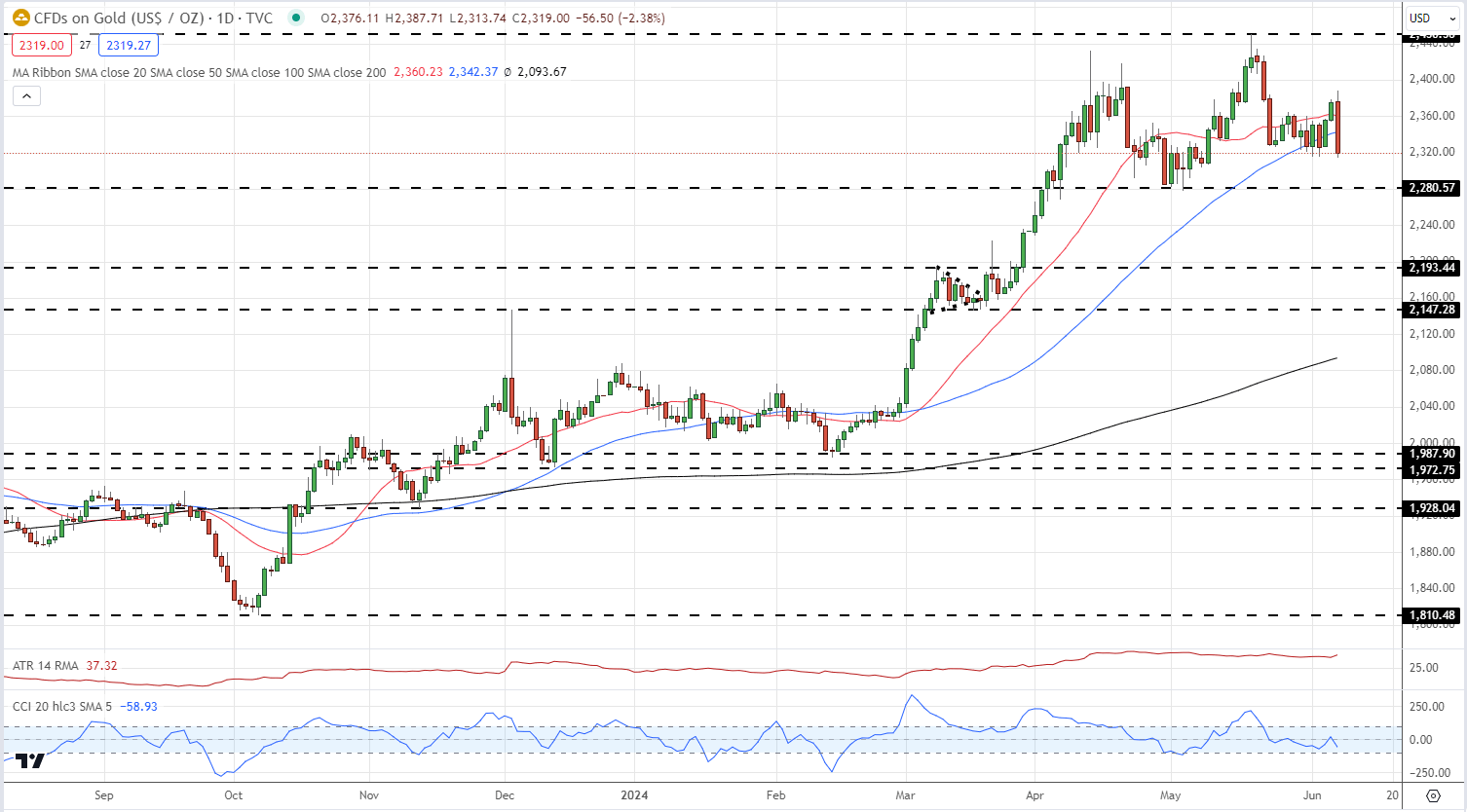

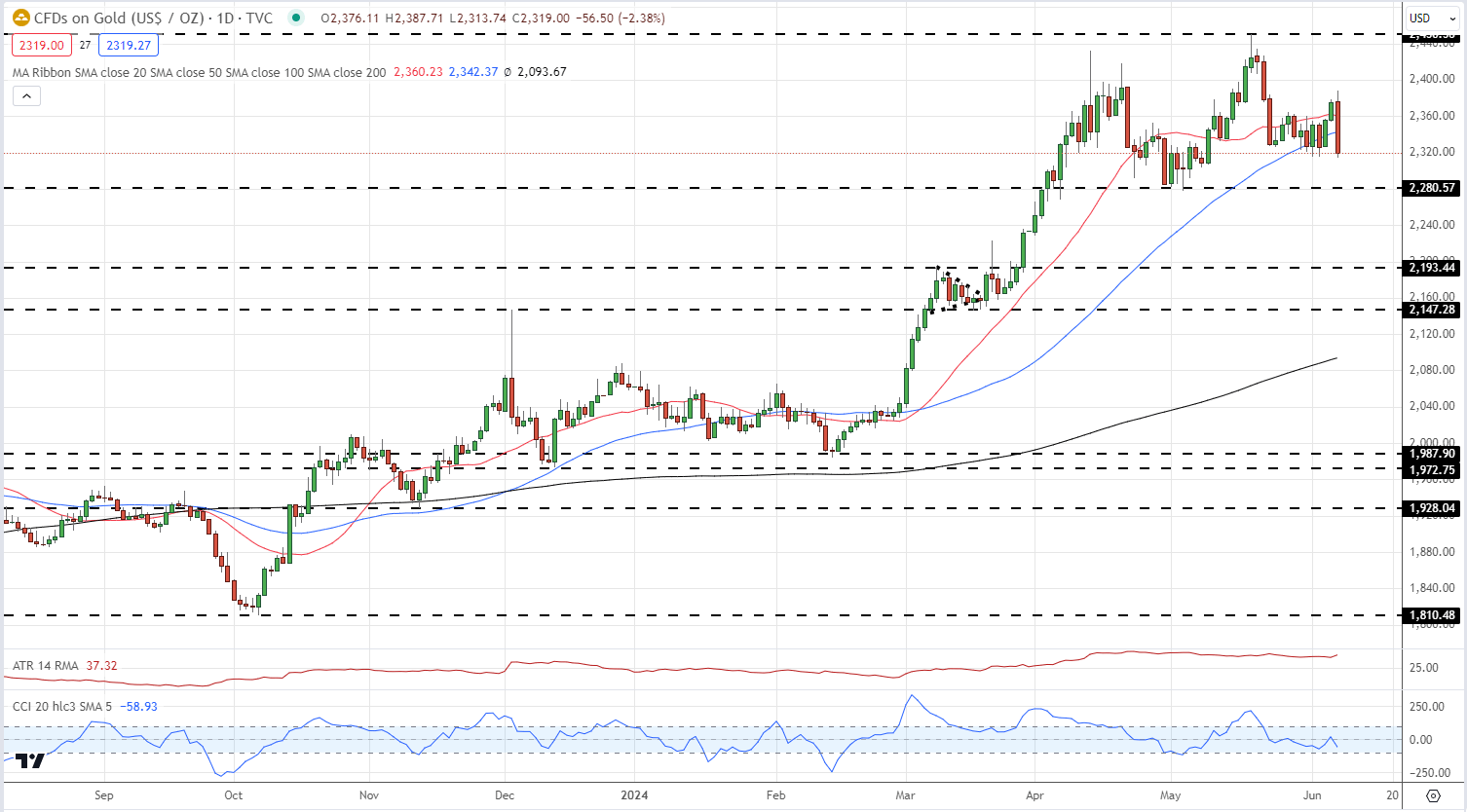

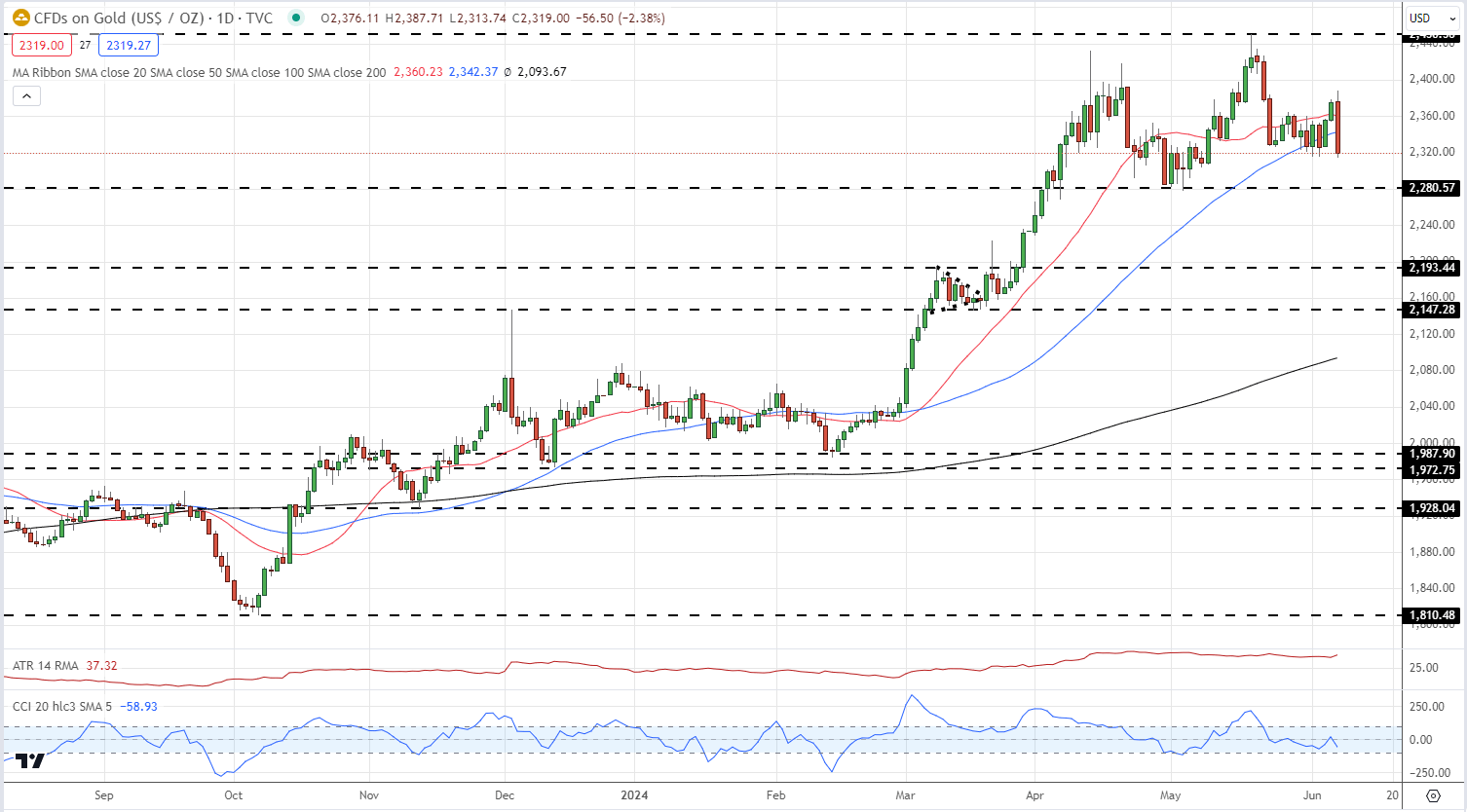

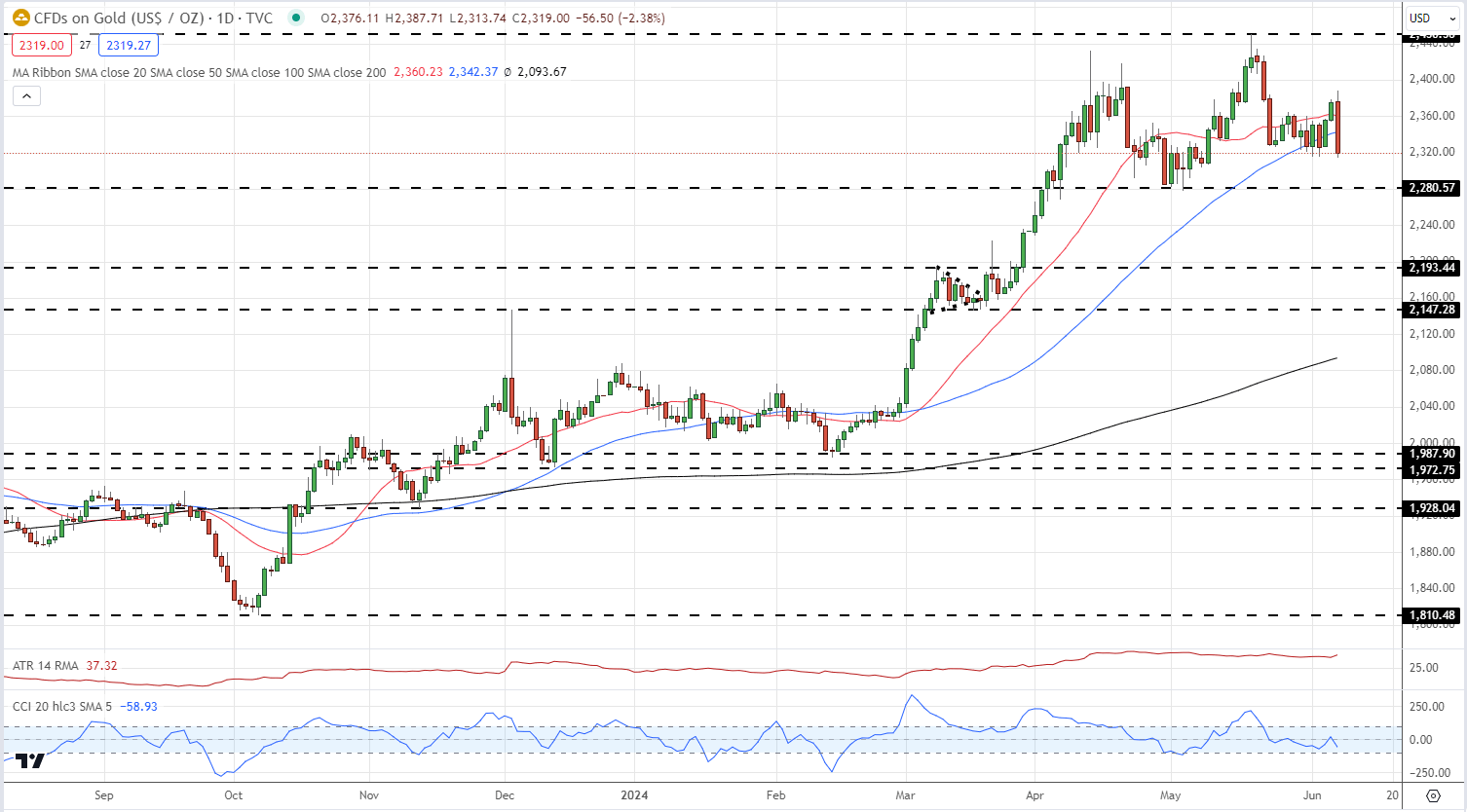

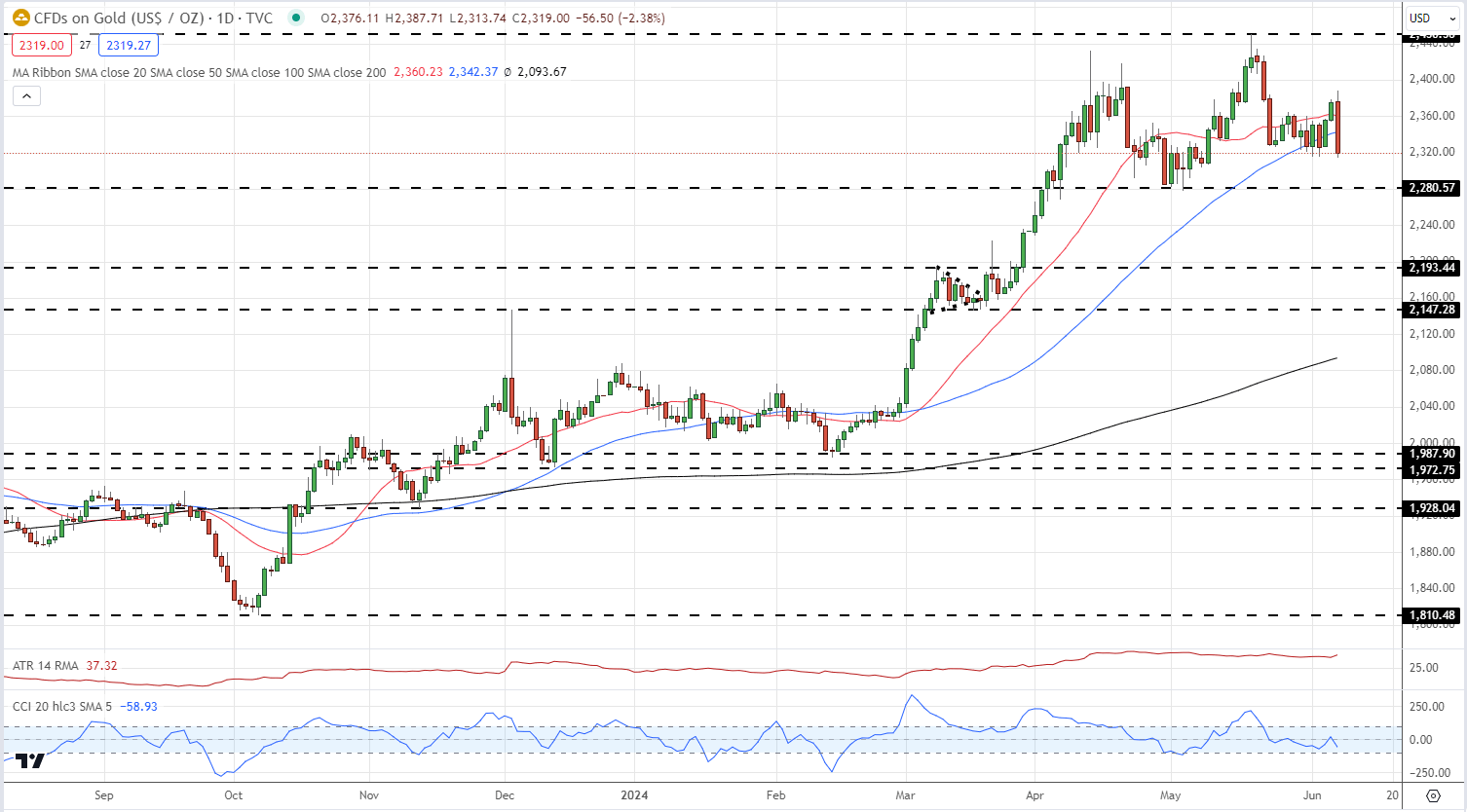

Gold is now posting a fresh one-month low and gold bulls have endured a difficult day. Earlier today a Bloomberg report noted that China had stopped buying gold, sending the precious metal down $20/oz. in quick order. A confirmed break and open below the $2,315/oz. would bring $2,280/oz. back into play.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -17% | -2% |

| Weekly | 1% | -14% | -4% |

Gold Daily Price Chart

All Charts by TradingView

Retail trader data shows 58.32% of gold traders are net-long with the ratio of traders long to short at 1.40 to 1.The number of traders net-long is 1.24% higher than yesterday and 10.13% lower from last week, while the number of traders net-short is 1.85% lower than yesterday and 0.09% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.